The post Aptos (APT) Shows Signs of Potential Recovery Amid Increased Network Activity and Trader Optimism appeared on BitcoinEthereumNews.com.

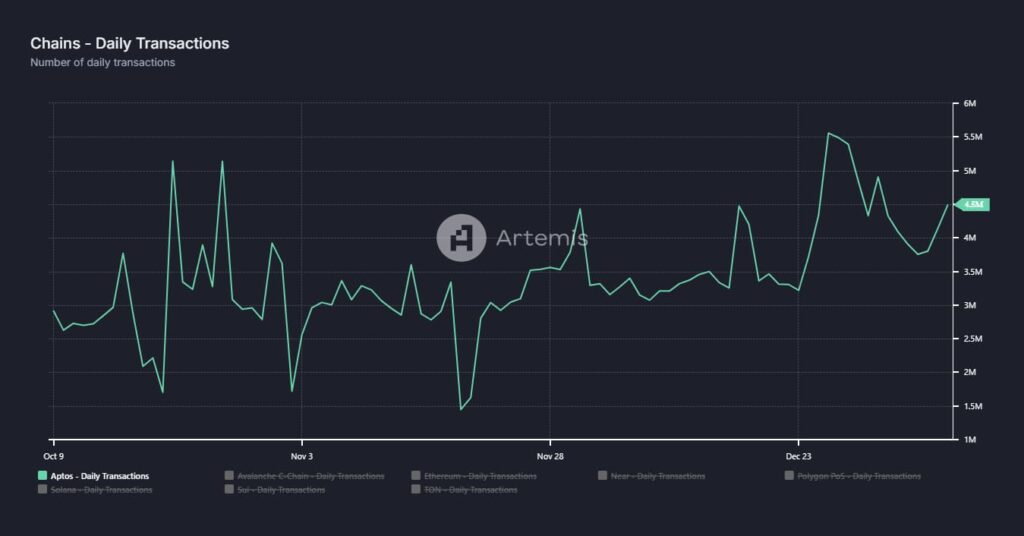

Aptos (APT) has emerged as a focal point in the crypto landscape, amidst fluctuating market conditions and impressive network activity. As APT’s trading metrics evolve, the community anticipates a potential reversal in its price trajectory, driven by renewed trader interest. “Despite recent setbacks, there are promising signs that APT could experience significant upward momentum,” reports COINOTAG analyst Mark Davidson. Aptos (APT) shows promising signs of a price recovery as active market participants increase, potentially setting the stage for a rally above $15. Aptos Network Activity Reaches New Heights Amid Price Pressure Data analysis indicates a remarkable uptick in crucial metrics for Aptos (APT), which could significantly impact its price in the near future. Reports indicate that daily active addresses have surged to 1.2 million, showcasing a dramatic uptick in user engagement and network utilization. Moreover, transaction volumes have recorded peaks of 4.5 million per 24 hours, reflecting a balanced mix of buying and selling activity across the platform. This represents a robust ecosystem and stakeholder confidence, crucial in influencing trading behaviors moving forward. Source: Artemis While such figures do not guarantee a price increase, the sentiment among traders is decidedly optimistic. The combination of increasing network activity and market participation is a potential catalyst for a turnaround. Traders Shift Strategies: Spot and Derivatives Exhibit Positive Momentum Recent market dynamics reveal increased buying engagements from both spot and derivative traders, hinting at a significant sentiment shift around APT. Data shows that APT’s net outflows from exchanges have rocketed to $15.05 million over the past week, compared to just $2.59 million the week prior. Source: Coinglass This sharp increase indicates that holders are opting for long-term strategies by moving their assets to personal wallets—an action frequently associated with bullish price movements. Concurrently, the funding rate in the derivatives market has demonstrated a…