The post Ethereum’s MVRV Ratio Drop Signals Possible Correction, Testing Key Support Between $2,230 and $2,610 appeared on BitcoinEthereumNews.com.

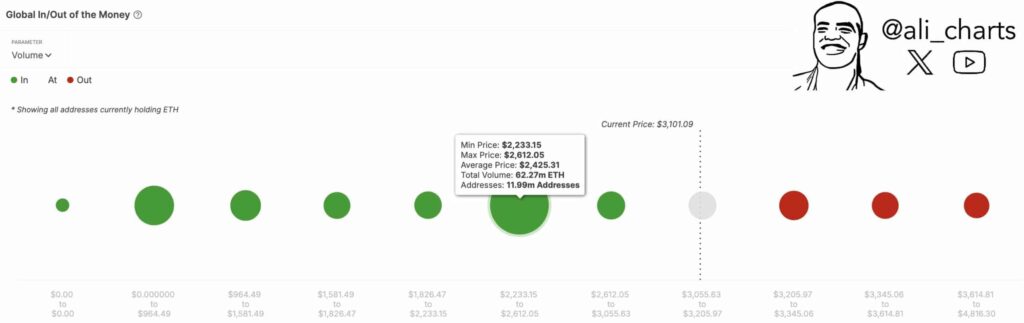

Ethereum’s MVRV ratio dip suggests a potential correction, with critical support between $2,230 and $2,610 highlighting market dynamics. With its MVRV recently falling below the 160-day moving average, traders eye a historically significant juncture for Ethereum. “ETH’s historical behavior within this range indicates the potential for future bullish trends,” stated a recent analysis by COINOTAG. Ethereum’s MVRV ratio signals potential price corrections, with crucial support levels tested, indicating future market resilience and bullish opportunities. Understanding the Implications of MVRV for ETH Ethereum’s recent Market Value to Realized Value (MVRV) ratio signals a critical juncture in the altcoin’s market trajectory. Having dipped below its 160-day moving average, this metric has traditionally acted as a key indicator of impending price corrections. For instance, ETH experienced a significant decline on June 23, 2024, when the MVRV indicated bearish sentiment, causing a swift decline from $3,500 to $2,100. Evolving Market Trends and Their Effects The current situation presents a stark reminder for traders to remain alert. As ETH grapples with the impact of the MVRV ratio decline, close attention to relevant market trends is essential. The correction pattern historically witnessed around similar metrics hints at a potential repeat of past volatility. Such movements necessitate a watchful eye on liquidity and market interest in upcoming days. A Potential Buffer for ETH Positioned within a critical support range of $2,230 to $2,610, Ethereum finds itself amid a significant accumulation zone, where roughly 11.99 million wallets hold about 62.27 million ETH. This range acts as a psychological barrier, potentialized by a strong buy interest that could cushion further price declines, stabilizing ETH in the turbulent short term. Source: AliCharts Traders are advised to observe how ETH interacts with this critical support. A strong rebound from this zone could imply bullish momentum, while a breach could trigger further…